2018 has been a difficult year on the markets, from a long-term-investing buyer’s point of view. What will happen in the coming year ?

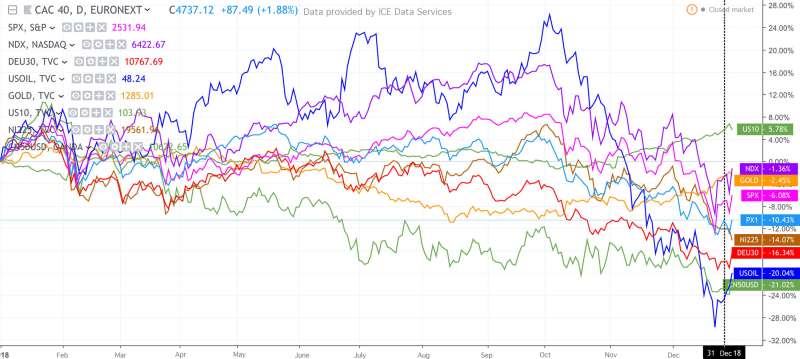

Here is an overview of market activity throughout 2018. Regarding the equity indices in the United-States, Nasdaq100 lost 2% and the S&P500 about 8%. In France, CAC40 dropped by 12% whereas our German friends got unluckier still with a 18% drop. Asia did not do any better : in Japan, Nikkei225 lost 12% and China’s A50 index suffered a 21% decline.

In terms of raw materials, investors who are eager to diversify have nothing to be glad about: gold lost 2% of its value. As to petrol (represented in blue on the chart), 2018 ended with an annual decline of 24%. Variations have been very unstable for this asset, with a 48% decrease in value over the last quarter.

Finally, if we look at obligations, the US ten-year yield bond rose by about 6%. Interesting, but this will not cover the losses on equity markets !

Shares : taking advantage of the decline

There is a great deal of uncertainty about shares. The recent declines have scared off investors who have decided to play it safe by selling their securities. Be that as it may, now might actually be the right time to run some errands ! Decreases can be very interesting in the long run. Now is the time to rebalance your portfolio, take a good look at company valuations and find equity securities that are delisted and have good potential for 2019 and beyond. You will want to be careful and be selective, though, by going through the whole stock market in order to identify promising securities.

Do not be afraid to go beyond the English framework. Why not analyse Nordic companies or check out the latest changes in emerging markets ?

In the midst of this hazardous bearish momentum, you will be better off leaving the usual big indices aside and looking towards stock-picking.

Interest rates and raw materials

Interest rate markets (and consequently obligations) and raw materials should be your main focus in 2019. The Fed had already started raising interest rates in 2018. Will it continue along that path ? Is the American economy strong enough to sustain this in the short term ? Probably… Or not ! This market must not be overlooked for it holds many opportunities. There again, do not hesitate to go and search through other countries’ monetary policies. The US and Europe are not the only ones to play with key rates.

Petrol and gold are not the only raw materials you can invest in either! Do not miss out on other resources such as energy, metals and agricultural commodities. For instance, you can to look into the price variations of platinum, palladium, wheat, corn, copper…

Trading and volatility

As reflected in the VIX (volatility associated with S&P500), odds are that global volatility on the markets should be relatively high in 2019. This is good news for trading. Investing part of your capital in riskier goods in 2019, for instance 5% to 10% of your portfolio, can prove fruitful.

Markets abound with opportunities. Wide fluctuations lead to good operations. In case you are not sure which market you should invest in, the first thing you can do is compare assets in terms of volatility. Preference will be given to goods that offer enough price variations to stimulate traders. What can be done with a flat and sluggish market ! Increases and decreases on the stock market rollercoaster make all the excitement… and profit

What about cryptocurrencies ?

Bitcoin and other cryptocurrencies have had a very tough year. In 2018, everything collapsed. Owners and other fervent believers in those new virtual currencies have bitten the bullet. There are now raging debates and a great deal of speculation as to whether 2019 will bring another spectacular price spike, or whether this was just part of 2017’s general price explosion.

In other words, can cryptocurrencies be considered an asset class in its own right ? Some say all of this is nothing but a scam. I would tend to think there is nothing wrong with having a small portfolio for several cryptocurrencies : who knows, even if the odds are not too good, there could still be an increase in the next few months.

Think about real estate !

Chaotic markets can be daunting to some, but real estate is always a safe bet. A little bit of cash at hand will help you save for a loan deposit, so you can start banking on rental investment. Real estate works no miracles but it will enable you to use credit leverage, which is always valuable. I would not recommend buying property with cash, unless you are purchasing your main residence. Right now, borrowing rates remain very affordable, so go for it!

Also, using various strategies, potential returns can be a lot higher (and less risky) than what one might expect of markets, especially in such uncertain conditions. Seize the chance to borrow from the bank whenever you can. It would be a mistake not to do so! !

| Excellent Rate | Very Good Rate | Good Rate* | |

|---|---|---|---|

| 15 Years | = 1,05 | = 1,19 | = 1,40 |

| 20 Years | = 1,17 | 1,39 | = 1,60 |

| 25 Years | = 1,25 | 1,58 | = 1,80 |

In a nutshell

2019’s motto « diversify » and « select » !

As is often the case, it is best not to put all your eggs in one basket. asset allocation principles : shares, obligations, raw materials… but also real estate.

In each case, I would advise you to pick stocks rather than follow overall trends: stock picking shares and obligations, detecting a property below the market price with just a few works to be done…

Keep some cash aside throughout the year, so you can be reactive and ready to seize the opportunities that are bound to arise.