Bitcoin enthusiasts, and fans of cryptocurrencies in general, have all noticed the “nice price hike” over the past few days. A slightly euphemistic phrase in light of the market gloom of 2018. How has this come about? Why now? Will it last?

Bitcoin seems to be making headlines again but doubts still abound on the market! The bulls (rising market buyers) and the bears (falling market sellers) are putting their dollars where their mouths are, along with a good sprinkling of arguments and predictions of varying levels of credibility.

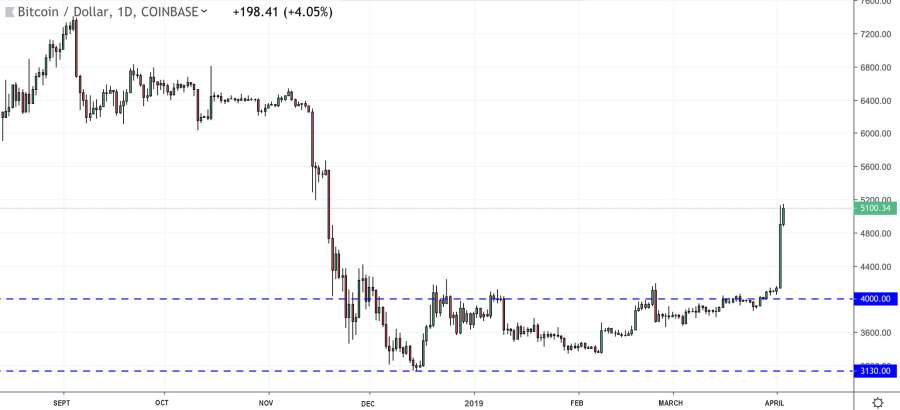

2018 was a bear year. Bitcoin went from $20,000 to $3130, an 84% drop. Will 2019 be a bull year? If so, it would be the second, the first being 2017 when Bitcoin skyrocketed 2400% from $800 to $20,000.

So choose your team. And sooner rather than later, because things are moving.

The markets

We’ll use bitcoin as the basis for our analysis since whatever is happening to the world’s top dog can be translated to, with the odd exception, pretty much every other cryptocurrency and token.

In December 2018, Bitcoin hit a low of $3130, followed shortly by a hike to around $4000. Nothing astronomical there. Cryptocurrencies are a highly speculative market with volatility almost guaranteed. Early 2019, Bitcoin hovered in this range, with a tendency to “stick” to a $4000 resistance level.

Late March-early April, Bitcoin broke this resistance and on April 2, up it went, nearing $5000 in under 2 days, which represents a hike of 25%.

If we have a quick look at some other cryptocurrencies, it becomes clear there is a strong correlation between Bitcoin, Ripple, Litecoin, Monero, Dash, Cardano, etc. With the exception of clear leaders Litecoin and Cardano, the market seems to be moving harmoniously like one big shoal…

Why this renewed optimism ?

Is the race on again, or is this simply a “break-out” at $4000? It could also be traders hedging short positions, or $4000 “stop orders”. Or are the bulls on the rampage? As we can see, this sudden increase in value could be down to a number of factors.

The fact is, this type of movement is neither surprising or out of the ordinary. We all know the cryptocurrency markets are home to frequent, sharp price fluctuations. What is note-worthy in this instance is that it has taken place at a time the market was thought to be “dead beat”, “on a break”, “asleep”. After the collapse in 2018, it was considered far wiser to bank on a continued drop than an unlikely rise.

This bullish surge should therefore make us prick up our ears as it is likely to be of a different ilk to past ones.

Bitcoin is no longer in its infancy, a time in 2015 when only risk-takers would invest in cryptocurrencies. Investors, be they professional or retail, are a tad more “in the know” now about the markets and relevant technologies, standing ready with their investment accounts and determination to do just that – invest!

In 2015 and 2016, many declined to invest because of their lack of understanding and an impartiality to taking risks. Today, they will be loath to miss the boat when/if prices start to rocket.

It is likely we will start to see the markets taking off again, with classic sheep behaviour taking over thereafter.

Bullish spark or booby trap ?

Gurus and ardent crypto advocates galore believe this rise is the sign of a future surge that will catapult the value of Bitcoin to stratospheric levels - $50,000, $100,000, even $500,000 and over. No limit to where it could end up! Bitcoin critics predict a value of…$0! The polar opposite. It seems that where cryptocurrencies and blockchain are concerned it’s one extreme or the other.

“Bears! Credit where credit’s due.” Lest we forget that 2018 witnessed three market rebounds that were systematically followed by a slide back down. Could that be what the coming months hold? If so, today’s buyers will really be kicking themselves.

So, what about the future ?

Owners of cryptocurrencies are currently licking their chops in anticipation of exponential growth of the markets. And the sceptics, rightly or wrongly, will be taking advantage of that very sentiment to get rid of their cryptocurrencies.

If we step beyond the short term and the evolution of speculative markets, what about Bitcoin and the hundreds of cryptocurrencies and tokens that are created each day? Is there any sense to all this or is it just one big joke? On us? What is the point of all these ICOs (Initial Coin Offering) and tokens that none of us understand the workings, or the value, of? There really is a legion of valid points the bears can use to support their point of view…

…And the opposition have a fair few hefty arguments in their favour, too. Are we not in the throes of a major technological revolution? Blockchain, secure payment methods, “inviolable” transactions, increased transparency… Aren’t we at the dawn of a revolution in which fiat currencies will be replaced by virtual currencies?

Only time will tell.

One thing, however, is certain - best not be on the wrong side of the track when the train comes in!