A mere two months ago, the most established and well-known of the cryptocurrencies was trading at barely $4000. In May 2019 it hit $9000, a 125% hike. How did this happen? What has got investors clamouring to buy Bitcoin? What is behind this renewed interest when things have seemed rather bleak over the last couple of months?

Although it is difficult to answer these questions with certainty, we can give some pointers as to what could have given the price of Bitcoin such a boost in the last few weeks.

The main reason seems to be down to supply; simply, there is a finite number of Bitcoin out there. The workings of supply and demand mean prices will logically rise. Some analysts even believe demand could outstrip supply, in which case, who knows how high Bitcoin could go.

Additionally, there have been some large sell orders executed across various platforms. Although seller identity remains confidential, the size of the transactions (millions of dollars) would seem to indicate we are talking about wealthy investors, maybe even large management companies or institutions. And the transactions were mainly around Bitcoin.

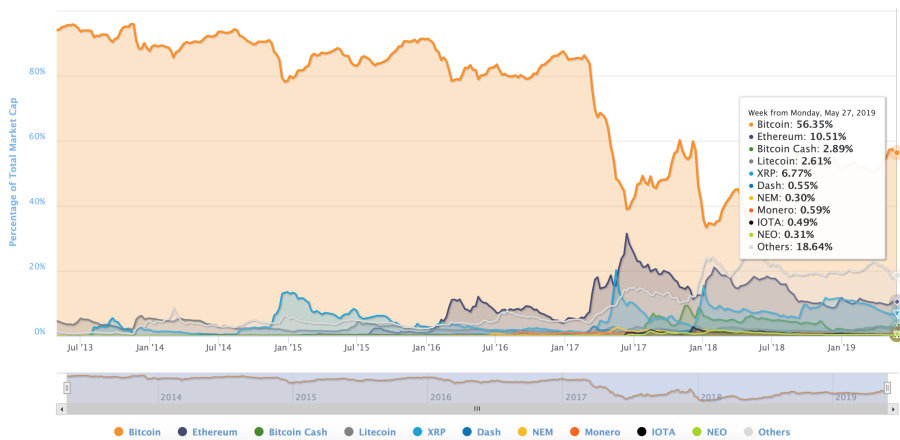

This brings us to a second point worth mentioning: a switch of capital to Bitcoin from other tokens and altcoins. Bitcoin remains the reference cryptocurrency on the market. Its market cap is nudging the 154-billion-dollar mark, which represents 56% of the market. It is followed by Ethereum, with only a 10% share. In 2018, Bitcoin went down to a mere 33% of the market. Since then, however, investors seem to have abandoned the smaller cryptos in favour of Bitcoin, perceived as safer, more liquid and less influenced by speculation.

Another explanation for the price rise is : the compounding effect we witnessed at the beginning of 2019. As the market stabilised and ceased its downturn, expected rises took place and investors slowly but surely started to reinvest in Bitcoin. As a result, the price consolidated until something had to give and the price shot up as witnessed in recent weeks.

Moreover, this sudden spike may have been fuelled by bearish traders buying back short sales. The $4000 seems to have triggered stops on short positions. This led to a wave of large purchases over a very short time period, hence the rapid rise in the market.

It is also important to remember that many traders who chose not to invest in Bitcoin were kicking themselves when the price of Bitcoin skyrocketed in 2017. It is likely they fully intend to be part of any new money-making hike and will be investing heavily if Bitcoin shows signs of moving towards $10,000 and then $20,000! They will probably be of the opinion that it would be better to buy now, even small quantities, than to sit and watch another potential opportunity fly by.

In the wider arena, Bitcoin is gaining in credibility as a valid asset in a diversified portfolio. This is partly due to the fact that it is not correlated to other markets such as equity or bonds, for example. When things are not going well on more traditional markets, investors can swap over to Bitcoin in a similar way they would to gold, for example. Gold, however, is not as popular as it once was, and Bitcoin seems to be a suitable alternative. It is therefore possible that investors have swapped over to, and are continuing to favour, Bitcoin.

The question on everybody’s lips is whether this current surge will continue in the coming weeks and months, or if prices will “collapse” like they did in 2018. Opinions on the question are as extreme as Bitcoin’s price variations! Some see it hitting $100,000 whereas others think Bitcoin is worth diddly-squat. What is certain is just how difficult it is to gauge what Bitcoin is or will become worth. It is a purely speculative market for now, where only the battle between buyers and sellers matters and there is nothing of substance to give weight to either position.

Bitcoin has, however, become an “indispensable” asset. After initially being hailed as a joke and a scam, its existence is now widespread knowledge, with even banks and institutions looking at it with interest. Financial authorities are trying to regulate what little they can regulate of Bitcoin and there are now dozens of platforms and many “serious” products available to trade Bitcoin… Basically, we are at the dawn of an emerging market, and irrespective of whether prices go up or down, we are probably already witnessing the entry of Bitcoin into the markets as a new large-scale financial tool.