2020 has been a challenging year on many levels. Because of the COVID-19 pandemic, the market has been incredibly volatile. Markets collapsed before skyrocketing and setting new records. Some have gained from it, while others have lost. But is all this behind us now? What will happen in the event of a second wave, or another lockdown?

In these uncertain times, many investors and traders are wondering which strategy to adopt.

What about a second wave?

It is actually already here. Multiple areas around the world have had to go back into lockdown, cities in countries such as Australia, Spain or Israel. We haven’t heard about it much because only cities and regions have gone into lockdown, rather than entire countries (for now). So, unless you live in these areas, you may not be aware of this.

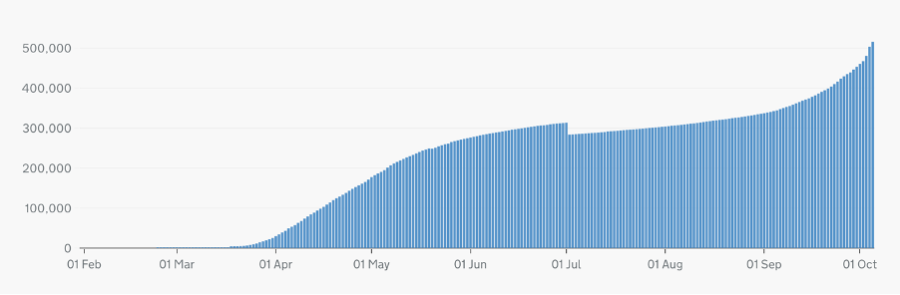

But this second wave is happening, and if you look at the figures, you will understand that no much is going in the right direction. Cases rise every day, and so is the death rate. Levels are actually much higher than when the epidemic started.

Number of daily cases in the UK:

Source : https://coronavirus.data.gov.uk/cases

No government wishes to go back into lockdown. Not only will it make people panic, it will weaken the economy even more. The situation is already tight in terms of work, trade and the economy. It is therefore in their best interest to avoid another lockdown that could be fatal and focus on prevention and hygiene instead.

How to explain the markets’ stoicism?

Markets plummeted spectacularly in February and March 2020. This is unlikely to occur a second time. At least, it will not be because of new waves of contamination. Companies are now better prepared than they were at the start of the year.

Now that we have had a “trial run”, we know how to prevent the spread of the virus (masks, hygiene…) and companies have set up remote working conditions. Both companies and their workers have adopted the right habits. On a personal level (i.e. with friends and family), not so much. Otherwise, we probably would not be experiencing a second wave.

However, this second wave and its economic implications could bear heavier weight on wider political and economic issues such as Brexit. From this point of view, macroeconomic indicators could deteriorate and impact the markets. Basically, another lockdown itself wouldn’t affect the markets, but a fragile system’s accumulation of unresolved issues over several years would. Among these issues: debt, central banks that artificially inflate the markets, and so on.

Where to invest right now?

At the stock market level, the risk is more sectoral than it is global.

In the event of another lockdown, physical stores, restaurants, hotels and tourism in general will be the ones to take the hit, yet again.

Tech and digital companies will be spared, as they usually are. Companies such as GAFA, Zoom or Netflix will emerge successful as they benefit hugely from people staying home.

However, stock prices for these companies have already increased significantly. One may wonder if their price and valuation are a little too high at the moment. This is probably true, but what else is there to be done if all else sinks?

It seems there are no alternatives.

What are investors’ safe havens?

When it comes to uncertain times, investing in gold is a solid option.

Since the beginning of 2020, gold has gained over 24% in value while the S&P500 has kept still (after a 30% drop) and the CAC40 is down by 21%.

Evolution of gold, the S&P500 and the CAC40 in 2020:

Note: bear in mind that the S&P500 benefitted from the exceptional performance of companies such as Facebook, Amazon, Apple, Microsoft and Alphabet (Google). These alone represent nearly 1/5 of the S&P500.

Is gold the only alternative to play it safe?

Of course, there are other solutions. For example, bonds help cushion market declines because interest rates continue to fall (when rates fall, bonds rise).

But, as always, diversification remains your best bet: never put all your eggs in one basket. Allocate risk to different asset classes, and make sure they are not correlated if possible.

More adventurous traders may find comfort in their cryptocurrency wallet. Bitcoin (BTCUSD) has risen by over 50% since the start of 2020. Bitcoin investors should remain cautious, however. The cryptocurrency collapsed at the same time as the equity markets in February/March 2020, so it is not risk-free either (is it ever?).

The importance of time frames

This is another example where identifying your time frame is of utmost importance. Your entire strategy depends on it.

If you are an active trader who is more interested in short-term investments, the COVID-19 pandemic is and will continue to be a real risk over the next few months. Therefore, you will need to have clear strategies in place to take this into account. If you tend to plan your investments over several years, you can focus on longer term strategies. However, you will still need to factor in possible post-COVID outcomes.

So, what’s next?

The market no longer seems to care much about the epidemic, particularly in the United States. Investors seem to have moved on and are now focusing on the next 5 to 10 years. A vaccine is likely to be developed in the near future so our current interrogations will lose their relevance. The virus will be an issue of the past, one we have overcome like many others before it.

The risk probably lies in the coming winter months, when the flu and other viruses are more widespread and can cause even more damage. Should contamination cases and death rates increase significantly, markets will most likely falter – at least in the short term.