Carlo

8 months, 4 weeks agoIt’s hard to feel optimistic about Tesla’s future right…

Read the comment

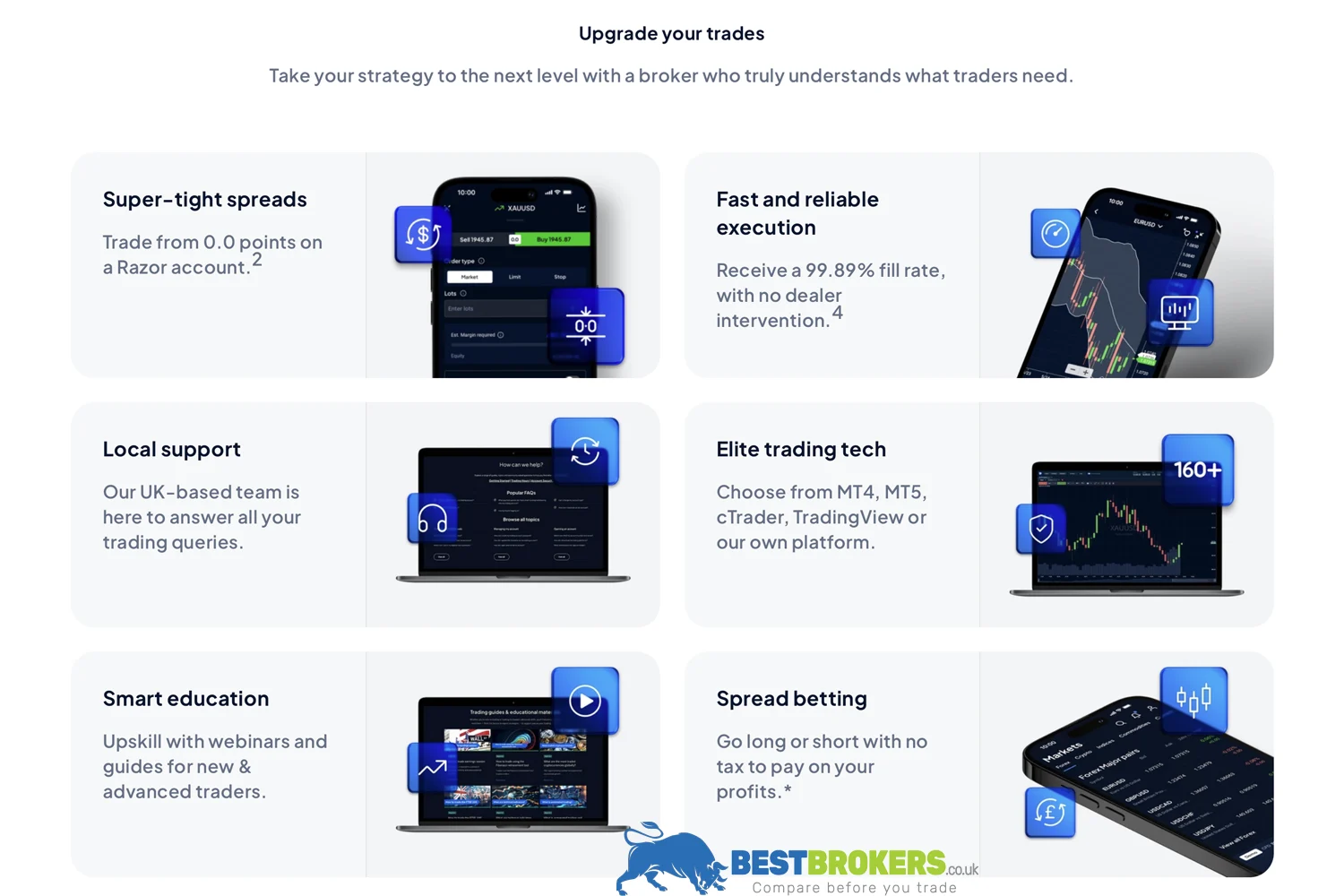

A truly international broker founded in 2010 in Melbourne, Australia, Pepperstone has a global presence, including in the UK, Germany, the Bahamas, Kenya, Dubai, and Cyprus. Nowadays, Pepperstone handles more than 12.5 billion US dollars in trades every day, making it one of the largest Forex brokers in the world, trusted by over 400,000 traders across more than 170 countries.

Pepperstone is primarily a Forex and CFD broker, but not exclusively so. More than 1,200 instruments are available, and Pepperstone allows you to trade shares, indices, commodities, and cryptocurrencies. In total, Pepperstone covers over 1,000 shares, 20 indices, 15 commodities, and 30 cryptocurrencies, all via CFDs. On the Forex side, Pepperstone covers more than 100 currency pairs, including major currencies, minors, and several exotics.

Here is a list of the financial instruments offered by Pepperstone:

Pepperstone specialises in CFDs and Forex, so the CFD range is extensive. Pepperstone’s spreads and commissions vary according to the type of account and the underlying asset. Overall, CFD trading fees are built into the spread, which is typically very competitive.

Two types of accounts are available: the Standard account and the Razor account.

An overview of the spreads on Pepperstone’s key instruments:

For share CFDs, Pepperstone applies fees starting from 0.02 USD per share, varying according to market conditions. These fees are especially attractive for traders looking to invest in a wide range of shares via CFDs while benefiting from extremely fast execution and very low transaction costs.

Start trading with Pepperstone

Forex fees are low. They vary depending on market conditions and typically start around 0.69 pip on EUR/USD, with slightly higher spreads for other currency pairs.

For cryptocurrencies, Pepperstone offers a minimum spread on Bitcoin against the US dollar of 13, averaging around 21.17. For ETHUSD, the average spread is 3. Pepperstone offers 12 crypto CFDs with up to 1:2 leverage.

Pepperstone offers its clients multiple platforms. The cTrader platform is designed for traders of all levels. Its interface combines simplicity and efficiency, with most orders executed in under 30 milliseconds. The platform offers several advanced tools, including algorithmic trading.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are also compatible with Pepperstone. Each platform meets different trading needs.

TradingView is also available, offering interactive charting and advanced technical analysis tools to optimise your trading strategies. This platform enables traders to customise charts, access a large library of technical indicators, and interact with a global community of investors.

Each platform has its own mobile application – cTrader, MT4, MT5, and TradingView – all compatible with iOS and Android. These apps provide advanced experiences with interactive charts and complex technical analysis tools for traders on the move.

Pepperstone is regulated by CySEC, the FCA, the CMA, BaFin, and the SCB, among others, and segregates client funds in Tier 1 banks. Pepperstone is also registered with the AMF.

Explore the Pepperstone platform

A good broker for derivative products, with a strong focus on Forex and CFDs. Competitive fees and high-performance trading platforms have enabled Pepperstone to establish itself among traders worldwide.

Admin

Last updated on 04/05/25 by Rosa