What is a Stock Exchange?

Generally speaking, a stock exchange is a place where supply meets demand. It is an institution, a type of social structure with rules either public or private, where properties and assets can be traded and their prices can be set.

There are commodity markets where goods (industrial raw materials, food products, raw energy supplies) are traded, and stock markets where securities (shares and bonds) are bought and sold.

In common parlance, « Stock Exchange » usually means stock market. This is our object today.

Stock Exchanges deal with both financial securities and financial derivatives. Currencies are not exchanged on a stock market. They are traded on the foreign exchange market (Forex).

There are several Stock Exchanges around the world, and the main ones in terms of market value are the New York Stock Exchange, the London Stock Exchange, and Euronext Paris.

Origins

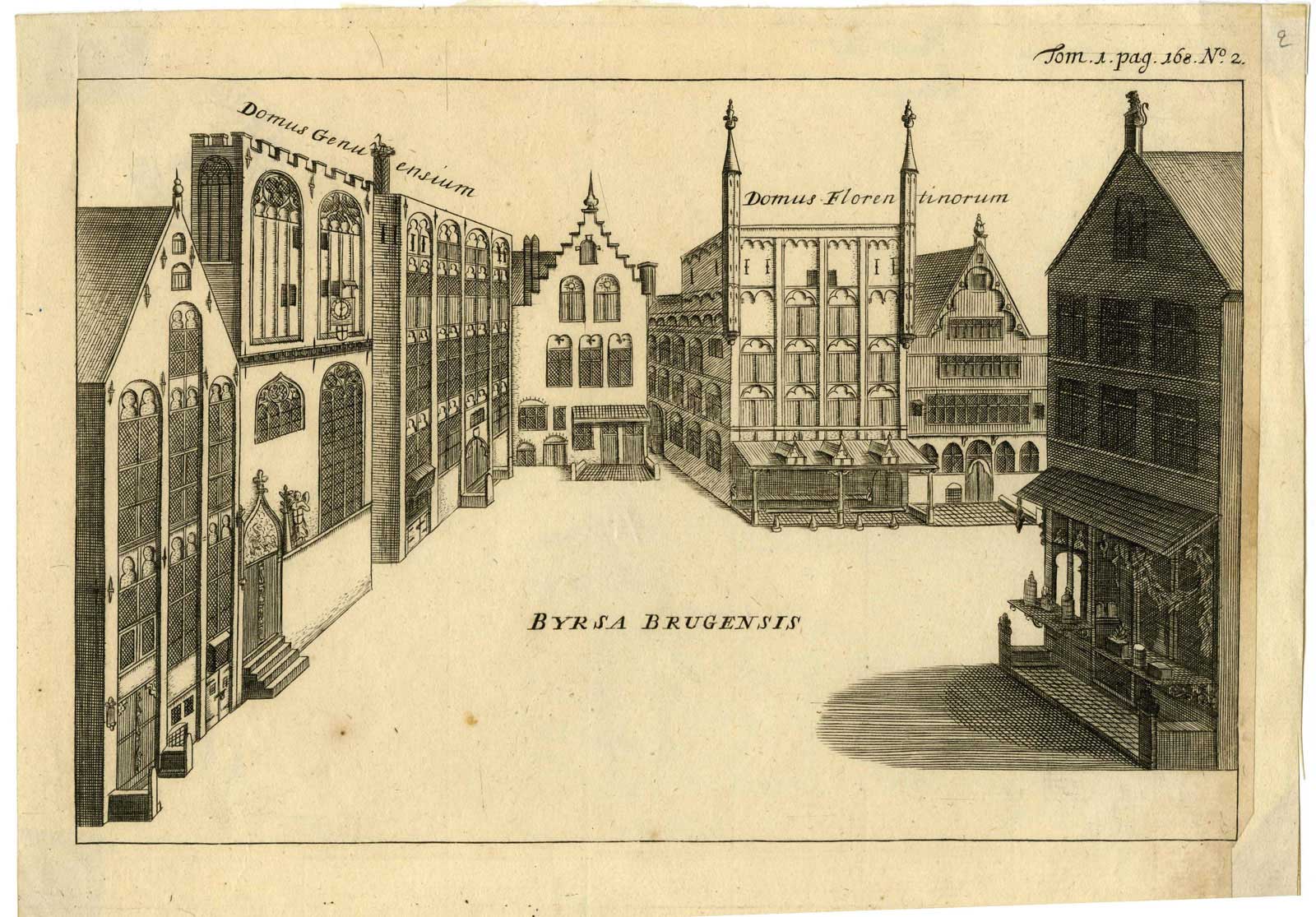

The French word « Bourse » meaning Stock Exchange nowadays, may date back to the beginning of the 14th century, when Bruges (Flanders) merchants went to trade at a town square named after the Van der Beursefamily. The phrase ‘to go to the Beurse’ thus became common usage.

What is the Stock Exchange for?

The Stock Exchange is first and foremost a funding and investment tool, but it is also used to manage risk and liquidity.

Businesses use it to find funds and invest by connecting capital supply and demand directly. They can access additional financial resources directly with an initial public offering or a capital increase. To do this, they issue shares or bonds on the ‘primary’ market.

Investors with a positive saving capacity use the Stock Exchange to place their savings by becoming shareholders or lenders for private companies or public sector entities. They can invest directly on the ‘primary’ market or turn to the ‘secondary’ market where existing securities are traded.

The Stock Exchange helps to manage risk by transferring it through the trading of shares and bonds. Investors can also avoid risk by using derivatives (Swaps, Forwards, Futures, options).

The Stock Exchange makes securities more liquid by making them tradable, which brings more investors to the market.

The Stock Exchange has another role as an economic index by quantifying the value of a company on the market, which can reveal the general trend of a country’s economy.

Lastly, the Stock Exchange is a monitoring tool for listed companies, as the publication of their accounts is strictly regulated and they are forced to broadcast information potentially affecting their share price.

On what principle is the Stock exchange based?

Nowadays, the term Stock Exchange usually means a financial centre where securities are traded. The Stock Exchange is thus truly a place, physical or virtual, where things are exchanged and supply and demand meet.

The Stock market therefore connects investors on the one hand, and economic players needing funds on the other.

Demand comes from people who can offer financing, who want to invest. They can be individuals, companies, States, as well as institutional investors such as banks, insurance companies, pension funds, etc.

Supply comes from businesses or States looking for financing to expand their activities. They issue securities which are bought by investors.

Transactions occur when securities are issued and bought. The difference between supply and demand directly impacts share prices and hence, sets market values.

How does the Stock Exchange work?

The Stock Exchange is made up of several markets:

The primary market is the market for ‘new’ financial products because it is used for initial public offerings (IPO) of shares by a company. There are several types of securities: subscription to an IPO (quotation), capital increase (shares) or bond issues (debt securities).

The secondary market is like a « second-hand » market. The original issuer is not involved anymore and products are sold on, mostly shares, bonds, and monetary instruments.

The Foreign exchange market, or Forex (FOReign EXchange), is where people trading currencies will meet.

There are other markets as well, for example current markets, over-the-counter markets, futures markets, etc… depending on how financial products are traded.

Trading shares

Public limited companies issue shares but only the largest and more popular are listed on the stock market. These are mainly the CAC 40, (Cotation Assistée en Continu - Continuous quotation of a stock) companies, in other words the 40 most important companies listed at the Paris Stock Exchange. Indices such as the CAC40 reveal a general trend in a market or sector, but indices can also be subjectively influenced.

For Francoise Giroud, founder of L’Express magazine in 1953, the stock exchange does not represent the real economy:

"The stock exchange does not reveal the state of the economy, but shows what investors think."

In most cases stock transactions, or trading, involve shares. A share is a portion of the capital of a company which can be bought or sold and whose price fluctuates depending on supply, demand, and company performance. The Paris Stock Exchange used to be an open outcry trading floor, open to the public. Nowadays you must use the services of a certified intermediary to invest in shares.

The Stock Exchange has a fundamental role to play in the current world economy, helping businesses find some of the capital needed for their development and helping the State finance its current accounts deficit.

The main Stock Exchanges around the world are Euronext (which manages the Paris Stock Exchange), the London Stock Exchange, the NASDAQ in New York, and the Tokyo Stock Exchange