Carlo

8 months, 4 weeks agoIt’s hard to feel optimistic about Tesla’s future right…

Read the comment

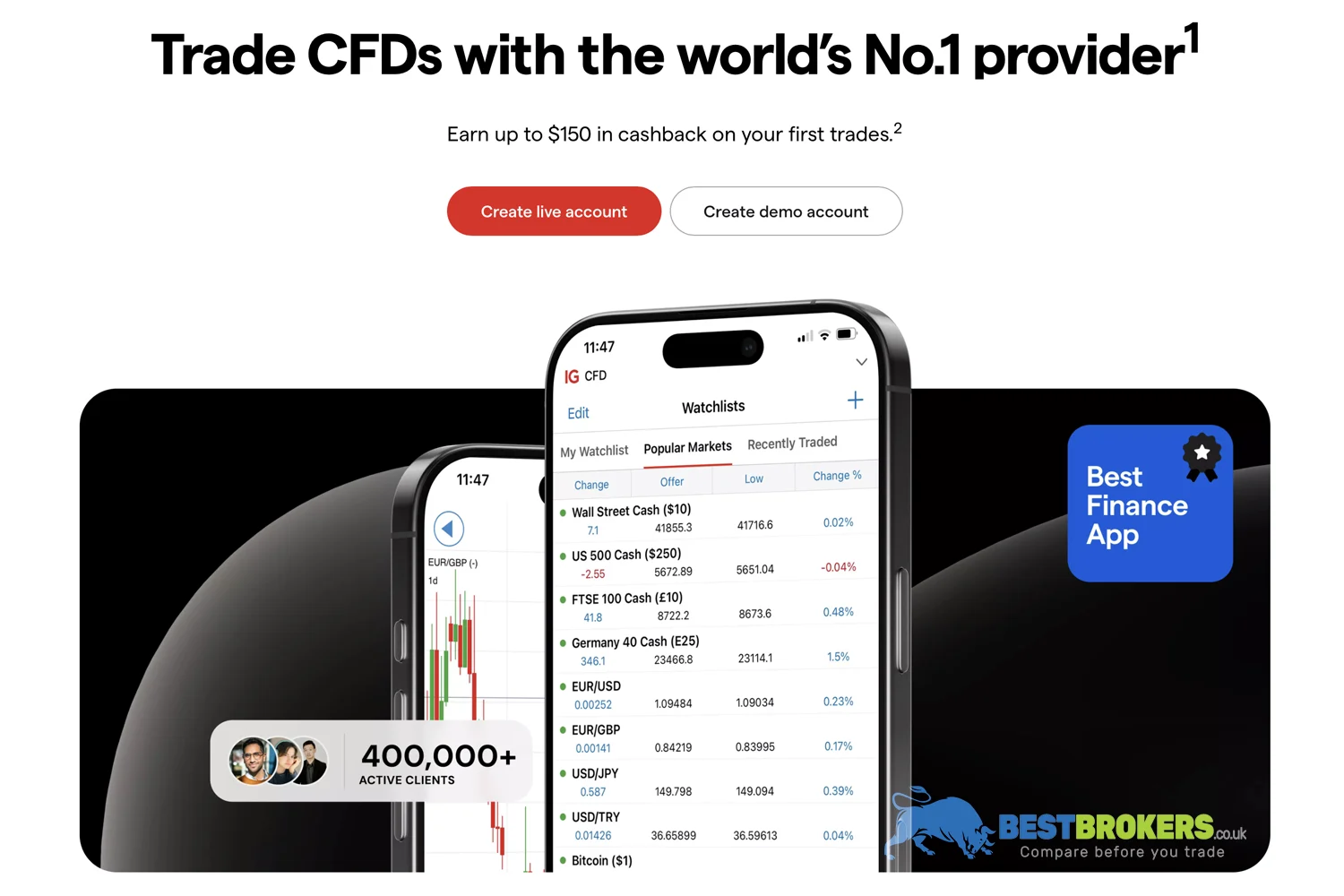

Undoubtedly one of the market leaders, IG — headquartered in England — was founded in 1974 and became one of the first to offer leveraged trading. Alongside IG’s technical and financial excellence, the company’s real strength lies in the large variety of assets available via derivative products, as well as offering (spread and overnight) fees among the most competitive on the market. Over time, IG has continued to innovate, adding cryptocurrencies to its instruments and also introducing 24/7 tradable Turbo24. IG has more than 313,000 clients across 17 countries and provides access to over 17,000 financial instruments across 20 stock exchanges. Its high-quality service and trading platforms have won multiple awards.

IG provides derivative products, particularly CFDs, Turbos, and options. These cover several asset classes: shares, indices, commodities, cryptocurrencies. Such instruments allow investors to apply varying degrees of leverage, whether long or short, across numerous underlying markets.

Here’s a list of the financial instruments offered by IG:

IG is known for transparent fees (spreads and swaps) that are clearly displayed before each trade. Spreads start at 0.8 points on major indices, around 0.016% in fees, and from as low as 0.1 points on commodities. Overnight fees (swap) on major indices are around 0.0055%.

*Please note these fees are indicative only and may vary according to market conditions.

An overview of the main spreads at IG:

For shares, there is a 0.05% commission with a minimum fee per stock market order of £5 on European shares and $15 on American shares, plus around 0.0069% as overnight fees. In practice, IG is only really cost-effective for larger orders (several thousand pounds).

IG also offers 6,000 ETFs—around ten on gold and five on oil—available via CFDs.

Regarding Turbo24, IG charges no commissions for orders above £300. For orders below that threshold, a £3 commission applies.

When trading cryptocurrency CFDs, IG charges 0.25% per transaction, with an overnight fee of 0.0694%. IG offers 17 cryptocurrencies, including popular assets such as Bitcoin, Ether, Litecoin, and EOS. Spreads for Turbo24 are built into the contract price, adding extra simplicity and transparency for traders interested in these derivative products.

Enjoy the exclusive offer from IG

IG provides a clear, user-friendly platform with a focus on technical analysis, featuring a customisable workspace where you can choose your own windows and indicators. The platform is both fast and intuitive, making it easy to find the assets you’re looking for. The IG platform is specifically tailored to CFD trading and perfectly suited for options and Turbo24 trading. All the expected features are present: multiple order types (market, limit, stop loss, take profit), charts with 17 timeframes that can be split into four separate views, 33 technical indicators, plus news, analysis, alerts, and more.

In fact, there is one platform interface for Turbos, and another for CFDs and options, but they are quite similar to each other. For those preferring a different setup, MetaTrader 4, Pro Real Time, TradingView, and L2 Dealer are all compatible.

IG has designed a bespoke trading app that gives you access to financial markets and lets you trade at any time directly from your phone. Available on iOS or Android, this app features everything you need to manage your trades: full-screen charts, indicators, order books, alerts, and more. It’s an excellent, user-friendly mobile trading solution.

Yes. With over 50 years of experience, IG is one of the industry leaders and is listed on the FTSE 250. IG provides security, transparency, and efficient services for your investments. The customer service is knowledgeable and responsive, and IG safeguards your funds through segregated accounts. IG is authorised and supervised by BaFin (the German Federal Financial Supervisory Authority) and the Deutsche Bundesbank, among other regulators.

IG is undeniably a top-quality broker offering a vast selection of assets at highly competitive prices. Specialising in derivatives, IG mainly caters to knowledgeable traders interested in short and medium-term trades (intraday or swing trading). With its advanced platforms and sophisticated tools, IG provides an ideal environment for capitalising on rapid market moves. However, IG is not designed for passive investors seeking long-term, family-style holdings. Such investors would likely find a more suitable service elsewhere.

Admin

Last updated on 04/05/25 by Rosa