Carlo

8 months, 4 weeks agoIt’s hard to feel optimistic about Tesla’s future right…

Read the comment

XTB, established in Poland in 2002, has positioned itself as a global brokerage leader thanks to its innovative trading platform and competitive trading conditions. Regulated by respected authorities such as the FCA in the UK and CySEC in Cyprus, and listed on the Warsaw Stock Exchange, XTB offers a secure trading environment for over 1 million clients across more than 10 countries. With competitive spreads, access to diverse global markets, free educational resources, and no direct commission on share dealing up to a certain monthly volume, XTB attracts both beginner traders and active investors.

XTB is a multi-asset broker offering its clients access to over 7,500 financial instruments, including more than 3,600 shares listed on 14 stock exchanges, around 1,300 funds and ETFs, as well as numerous CFDs. These CFDs allow you to trade on over 70 currency pairs, 30 indices, 25 commodities, and 41 cryptocurrencies using leverage.

Here’s a list of the financial instruments offered by XTB:

XTB offers a CFD trading platform that enables you to invest in a wide range of assets, including Forex, shares, indices, and cryptocurrencies. The platform is distinguished by its competitive spreads tailored to different investor profiles, and favourable trading conditions across various financial instruments. XTB primarily earns through spreads, commissions, and overnight financing fees, which vary by instrument and market conditions. With spreads as low as 0 pip for the Pro account (with a commission per lot), XTB provides maximum flexibility and cost efficiency, although fees on cryptocurrencies may be higher.

Overview of the main spreads at XTB:

Start trading with XTB

Free Share – use code TOPVIP.

For shares, XTB charges a fee of 0.05% with a minimum commission per order of £5 for European shares and £15 for American shares, plus an overnight fee of about 0.0069%. In other words, for small orders, XTB is only really attractive for larger transactions (several thousand pounds).

XTB also offers 6,000 ETFs – roughly ten on gold and five on oil – which are traded via CFDs.

Regarding the Turbo24 offering, XTB charges no commission on orders over £300. For orders below £300, a commission of £3 is applied.

XTB is highly competitive in Forex and CFD trading, offering a wide selection of currency pairs with low spreads. Available 24 hours a day, 5 days a week, this range includes both major and minor pairs. For cryptocurrencies, XTB offers CFD trading on various digital currencies without allowing direct purchase or actual ownership of these assets.

Claim your exclusive XTB offer

Free Share – use code TOPVIP.

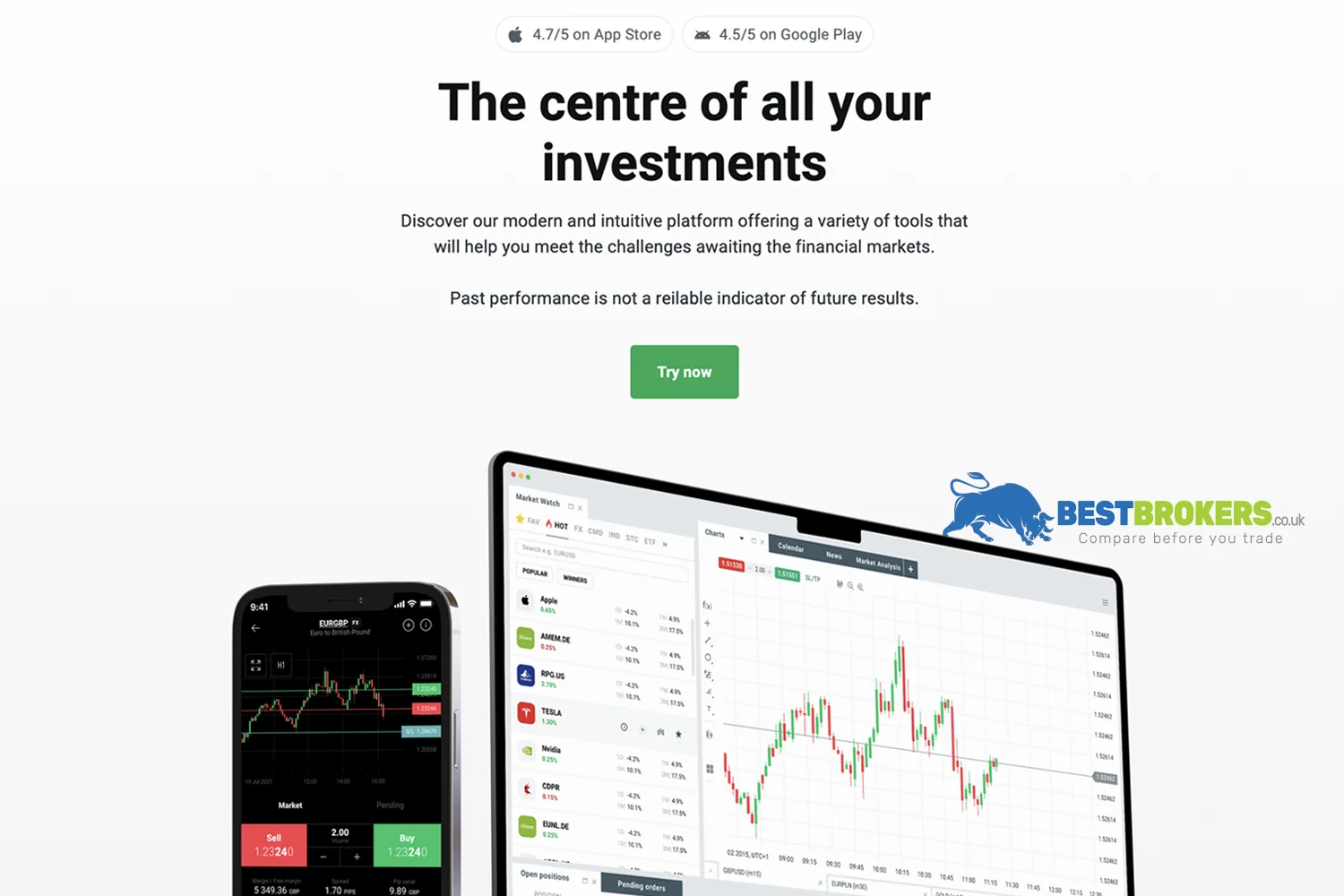

xStation 5, XTB’s proprietary trading platform, has been developed to offer an intuitive and high-performance user experience. Accessible via web, desktop, and mobile without any downloads, it is designed for practicality and flexibility. The platform provides advanced analysis tools, interactive charts, and real-time market analysis, meeting the needs of every trader. Fully customisable, xStation 5 allows you to set up price alerts and offers direct access to tutorials, webinars, and market analyses. Recognised for its speed and user-friendliness, it has received awards such as the “Grand Prix de l’Excellence 2019” and the “Best Execution” award by IAT.

Here’s a list of the key features offered by xStation 5:

Join XTB and start trading

Free Share – use code TOPVIP.

The xStation Mobile app from XTB, available on both Android and iOS, is an extension of the desktop xStation 5 platform, offering an optimised experience for smartphones and tablets. With a simple and intuitive interface, it provides all the features of the desktop version – including interactive charts, price alerts, an economic calendar, and real-time technical analysis. Users can manage their accounts and trades using tools like stop-loss orders and receive customised notifications.

XTB is recognised as a trustworthy broker in the online trading industry, with over 15 years of experience and serving more than 1,300,000 clients worldwide. XTB is a multi-regulated broker authorised by the FCA and other respected bodies. Client funds are held in segregated accounts as required by regulations, offering additional protection, and are covered by an investor compensation scheme.

Explore the XTB platform

Free Share – use code TOPVIP.

With over 15 years of experience, XTB is a reliable and versatile broker that caters both to general investors interested in shares and ETFs and to active CFD traders. With its modern trading platform, a registered office in the UK, exceptional customer service, full fee transparency, and a wide range of financial instruments to maximise trading opportunities, XTB stands out as a quality broker.

Admin

Last updated on 10/12/25 by Carlo